August 12, 2021 -- A new analysis of publicly reported financial information from pharmaceutical companies found that reducing drug prices would have no impact on R&D innovation and future drug approvals. The findings were published in a white paper titled "Will Reducing Drug Prices Slow Innovation?" on August 9.

Recently, the U.S. Congress has aimed to reduce drug prices to ensure that essential medicines are affordable to all Americans. However, a primary concern raised by the pharmaceutical industry is that reductions in drug prices would lead to industry R&D investment reductions, eventually affecting the quality and/or quantity of new treatments.

A recent report from the Congressional Budget Office analyzed the potential impact of legislation (HR 3) that would authorize the secretary of health and human services to negotiate drug prices paid by Medicare or Medicaid. The report concluded that "the prospect of such lower revenues would make investments in R&D less attractive to pharmaceutical companies." As it currently stands, product pricing and size of the available market are considered the primary determinants of R&D spending in the biopharmaceutical industry.

However, other analyses suggest a different scenario. According to a 2019 white paper from the West Health Policy Center and Johns Hopkins Bloomberg School of Public Health, large pharmaceutical companies have a significantly higher return on invested capital compared to companies in other sectors, and these large companies could endure revenue reductions while maintaining current research investments.

"Drug makers have hidden behind the unproven notion that skyrocketing drug prices are necessary to sustain innovation," said Tim Lash, president of the West Health Policy Center, in a statement. "This research debunks that myth -- confirming policymakers do not need to make a false choice between lowering costs now and bringing new products to market in the future."

Emerging biotech companies have different R&D spending strategies

Approximately 40% of new products were originated and launched by emerging small biopharmaceutical companies between 2016 and 2020. Another 20% of products came from development programs initiated by emerging companies but were launched after licensing or acquisition by larger firms.

Many small biotechnology companies have science-based business models, where return on investment is dependent on the increasing value of intellectual property and potential applications rather than projected return on investments from specific products. Further, these companies are usually founded to advance a specific technology or cure a specific disease, and thus they allocate R&D spending to maximize opportunities in these respective spaces.

How do revenue reductions affect small and large pharmaceutical companies?

The new analysis was conducted by a team from Bentley University's Center for Integration of Science and Industry in partnership with the nonprofit, nonpartisan organization West Health Policy Center. It considered the relationship between revenue and R&D expense for all publicly traded biopharmaceutical companies (1,379) for the years 2000 to 2018. Large pharmaceutical companies were defined as having a market capitalization greater than $7 billion, and small biopharmaceutical companies were defined as having a market capitalization under $7 billion.

For large companies, reductions in revenue were directly associated with reductions in R&D spending, whereas for smaller companies, changes in revenue did not impact R&D expenditures. The analysis also revealed that between 2010 and 2019, 60% of clinical trials were sponsored by small biopharmaceutical companies, which accounted for 70% of products in phase III trials.

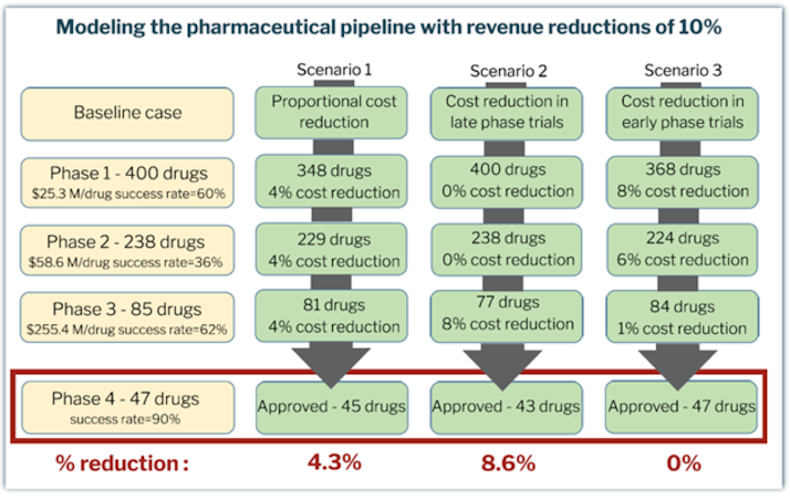

Using a model that incorporates published data on per-drug costs of each clinical phase, as well as phase transition success rate, the team analyzed R&D spending proportional to a reduction in revenue for companies of different sizes. The model suggests that at baseline, 47 out of 400 candidate compounds would be approved. The model considered three scenarios in which a 10% decrease in revenue from the baseline could affect pharmaceutical companies in the following ways:

- Candidates entering each clinical phase are reduced proportionally, resulting in two less product approvals.

- Candidates entering late phase trials are reduced, resulting in four less product approvals.

- Candidates entering early phase trials are reduced, resulting in the same amount of approvals.

"Our model suggests that the industry's best practices are sufficiently robust to accommodate the decrease in drug prices anticipated by H.R. 3 without decreasing the number of new drugs coming to market," said senior author Dr. Fred Ledley, director of the Center for Integration of Science and Industry. "Importantly, we believe this can be achieved without fundamental changes to the industry's financial, management or marketing practices, or their priorities."

The analysis demonstrates the ability of large pharmaceutical companies to mitigate the impact of lower drug prices on product development pipelines through the strategic allocation of cost reductions to different phases of clinical development, according to the authors.

"These findings affirm the concerns of the American public and make clear that drug manufacturers can sustain reductions in drug spending under recent legislative proposals without impacting innovation," said Sean Dickson, director of health policy at West Health Policy Center.

Do you have a unique perspective on your research related to drug discovery or development? Contact the editor today to learn more.

Copyright © 2021 scienceboard.net