January 28, 2022 -- 2021 was an especially active year for private equity (PE) firms. According to PitchBook, the number of deals surged over 51% last year to top 8,600. Among the beneficiaries of the 29% increase in deals were biotool firms, which supply laboratory instrumentation and aftermarket supplies for the analysis of genes, cells, and proteins (excluding in vitro diagnostics tools).

To advance biotherapeutic development and manufacturing, as well as clinical research, especially in the case of new therapeutic modalities, breakthrough technologies are needed to study and understand biomolecules and biological mechanisms. Ultimately, these technologies play a key role in improving R&D productivity and disease treatment.

But a breakthrough technology or technology improvements are not all that is needed. To commercialize such tools, companies look to provider faster, simpler, and more user-friendly and comprehensive solutions, as well as more cost-efficient and productive alternatives to current choices.

Thus, it is not surprising that the top three private biotool companies in terms of PE funding last year were firms aiming to make new technologies more accessible to laboratories and companies offering tools tailored to specific applications. These three companies consist of one breaking into an established technology market and two that are pioneering the commercialization of systems designed to broaden the use of the latest scientific advancements.

DNA sequencing

DNA sequencing is not a new technology, but current solutions do not meet all researchers' needs. As a result, Element Biosciences was one of the biggest winners of funding among biotool firms last year, scoring $276 million in a series C round. The company's benchtop DNA sequencing instrument for research and diagnostics is currently under development and promises advances in performance, cost, and flexibility.

New investors in the financing round included Janus Henderson Investors, Logos Capital, Meritech Capital Partnerships, Counterpoint Global (Morgan Stanley), and T. Rowe Price. Existing investors include Fidelity Management & Research Company, Foresite Capital, JS Capital Management, RA Capital Advisors, and Venrock. In total, the company raised $400 million.

Within the sequencing market, where Illumina holds a dominant share, Element Biosciences is focused on innovation.

"Element has developed a differentiated, modular, platform-based approach that reinvents all aspects of a DNA sequencing solution," John Stuelpnagel, DVM, chairman of the board of directors, said.

Stuelpnagel was a co-founder of Illumina and now sits on the board of biotool providers 10x Genomics, Inscripta, and Fabric Genomics. Molly He, PhD, Element Biosciences' CEO, co-founder, and board member, is also an Illumina veteran, having served as senior director of scientific research.

Founded in 2017, Element Bioscience has over 175 employees as of June 2021. Element Biosciences has released few details so far about its technology and commercialization timeline.

DNA synthesis

The next generation of benchtop DNA synthesis systems has only recently begun to be commercialized. In January, DNA Script completed a $200 million series C financing round, bringing the total it has raised to $315 million.

As with Element Biosciences, T. Rowe Price Associates and Fidelity are among the firms' investors. Other new investors include Baillie Gifford, Healthcor Management, Eurekare, and Irving Investors. Among the existing investors participating in the round were Coatue Management, Catalio Capital Management, Columbia Threadneedle Investments, and Casdin Capital.

DNA Script launched its first product, the Syntax enzymatic synthesis platform, in 2021. Traditionally, oligonucleotide synthesis has relied on chemical methods. Alternatively, enzymatic synthesis promises a faster and more accurate approach and the production of longer sequences. The Syntax system can also be used by scientists in their own labs rather than relying on outside service providers.

"We had a targeted commercial launch of the Syntax platform in June 2021, distributing a fully functional instrument to academic, government, and commercial entities in the U.S. and Europe," Thomas Ybert, DNA Script CEO and co-founder, told ScienceBoard. "This launch was targeted to ensure customer satisfaction and fit-for-purpose capabilities."

New products are due this year.

"We anticipate launching a new version of kits this year to enable Syntax users to synthesize longer oligos with more mass per oligo and oligos with modifications, including fluorophores, quenchers, and biotin labels," Ybert said. "That will be followed by the launch of our new model of the Syntax instrument to enable higher plex."

The company has 150 employees.

Genome engineering

CRISPR revolutionized gene editing, but automation and standardization of the CRISPR gene editing workflow could further transform genome engineering. Inscripta, maker of the Onyx digital genome engineering platform, closed a $150 million series E round last spring.

As with Element Biosciences and DNA Script, T. Rowe Price and Fidelity Management & Research Company were investors. The round was co-led by Fidelity, and T. Rowe Price advised funds and accounts involved with the investment.

New investors included D1 Capital Partners and Durable Capital Partners. Existing investors Foresite Capital, Counterpoint Global (Morgan Stanley), and JS Capital also participated. The latest financing brings the total raised by the company to more than $400 million.

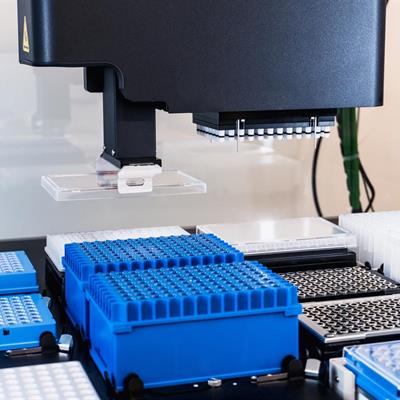

A microfluidics-based benchtop solution, the Onyx digital genome engineering instrument automates steps in the design and production of CRISPR-edited cell libraries, including cell growth, electroporation, and gene editing. The instrument simplifies and speeds CRISPR-based editing. Users order customized kits that can be used to create 10,000 edits per experiment.

Inscripta began commercial shipments of the system last year. Synthetic biology firms Amyris and Ginkgo Bioworks currently use Onyx. Inscripta is also generating revenue by licensing its CRISPR nucleases.

Sri Kosaraju, president and CEO of Inscripta, said at the time of the launch, "In addition to our excitement about the Onyx platform, we see further future potential with our innovation, which is captured by our IP portfolio of nearly 100 issued U.S. patents."

Kosaraju also acknowledged the role of investors. "To this end, we are fortunate to have the support of some of the world's most notable investors who share our enthusiasm for the long-term opportunity to build transformative technology and an impactful organization."

Tanya Samazan is managing editor of Instrument Business Outlook (IBO), a twice-monthly newsletter aimed at providing decision-makers with the latest and most complete information available on the life science and analytical instrument industry.

Disclosure: ScienceBoard is a sister company of IBO.

Do you have a unique perspective on your research related to biotech finance or biotools? Contact the editor today to learn more.

Copyright © 2022 scienceboard.net