April 23, 2020 -- As the COVID-19 outbreak advances worldwide, companies are stepping up to the challenge to develop a potential vaccine. There are over 75 confirmed COVID-19 vaccine candidates, five of which have already entered clinical trials. In its recent report on vaccine development, Kalorama Information -- a Science Advisory Board partner -- has tracked companies that are developing vaccines for COVID-19.

The demand for a COVID-19 vaccine has prompted a renewed focus on what is one of the more challenging segments of therapeutics, for various reasons:

- Vaccines are probably the most disparate of all biologicals, with vaccine types ranging from relatively simple peptides to entire cells, and a limited number of manufacturing methods are available for each vaccine.

- Production systems must create products of consistent safety and quality while maximizing yield.

- Vaccines are administered in fewer and smaller doses to a much larger patient population than other biologicals.

- Per-dosage prices are a miniscule fraction of nonvaccine biologicals, and manufacturers have little financial incentive to modify production technologies.

All this being said, the war footing of the nation against COVID-19 has had an obvious impact on the speed of the development process for COVID-19 vaccines. First doses of COVID-19 trial vaccines were injected into patients as early as March. As of this writing, one company is in phase II and four companies already have vaccines in phase I development.

Such rapid progress is unheard of, given the complexity and time needed to develop a vaccine.

Vaccine trials

What is that process? The trial process for vaccines differs from other therapeutics as well. Vaccine clinical development in the world's major markets follows a similar pathway as for drugs and other biologics.

A sponsor that wishes to begin clinical trials with a vaccine must first obtain permission to conduct clinical studies. In the U.S., this requires the submission of an investigational new drug (IND) application to the FDA. The IND describes the vaccine, its method of manufacture, and quality control tests for release.

Also included is information about the vaccine's safety and ability to elicit a protective immune response (immunogenicity) in animal testing as well as the proposed clinical protocol for studies in humans.

- Premarketing (prelicensure) vaccine clinical trials are typically done in three phases, as is the case for any drug or biologic.

- Preclinical testing involves study of the candidate in animals to determine basic safety characteristics.

- Initial human studies, referred to as phase I, are safety and immunogenicity studies performed in a small number of closely monitored subjects.

- Phase II studies are dose-ranging studies and may enroll hundreds of subjects.

- Phase III trials typically enroll thousands of individuals and provide the critical documentation of effectiveness and important additional safety data required for licensing.

At any stage of the clinical or animal studies, if data raise significant concerns about either safety or effectiveness, the developer may discontinue testing of a product. This is a common occurrence, with a very small proportion of product candidates progressing from one stage of testing to the next. As with drugs and other biologic products, the full process from conceptualization through phase III testing typically takes eight to 12 years and often costs hundreds of millions of dollars.

The complexity of vaccines creates a unique set of challenges during process and product development. Ways in which vaccine trials are different include the following:

- Therapeutic drugs are given to patients, but vaccines are given to healthy individuals, thus the safety margin should be very high. For a vaccine that is administered to children, safety is first tested in adults, followed by adolescents, children, and lastly infants.

- As most vaccines must be stored under refrigeration, there are always logistical challenges during clinical trials, considering that phase II and phase III are field studies.

- Adjuvants are incorporated into vaccine formulations to modulate and improve the immune response. The compatibility of the adjuvant with the vaccine antigen and the quality and stability evaluation of antigen/adjuvant formulation are important aspects that have to be developed as much as the vaccine.

- Rather than a therapeutic effect, the quality of effect in terms of the immune response must be measured during the early stages of vaccine development (phase I/II) and should evaluate the following: the amount, class, subclass, and function of each specific antibody.

Developing a vaccine requires $500 million to $1 billion in investment, recent estimates suggest, while only 7% to 10% of projects result in a vaccine. As a result, even today, with a pandemic raging, many small biotech firms are watching from the sidelines.

Those working on vaccines rely on money from foundations and government initiatives. Two of the most promising developers of a COVID-19 vaccine, Inovio and Moderna, are funded by the Coalition for Epidemic Preparedness Innovations (CEPI), an alliance of charities and governments.

Prior to regulatory approval, a vaccine candidate usually undergoes three phases of development in humans, which, for the most part, progress sequentially: phase I, phase II, and phase III. After successful completion of phase III trials and following licensure of the product, in phase IV studies, vaccine doses are received by healthy individuals, thus the safety margin should be very high.

In-house versus outsourcing vaccine development

Manufacturers tend to make their own vaccines. Because of tight quality control concerns, regulation, and the small number of very focused companies in the vaccine space, contract manufacturing in vaccines is not as prevalent as in other areas of pharma manufacturing -- even compared with biomanufacturing. It seems to be more prevalent among small and midsize players. Large pharma companies such as GlaxoSmithKline, Pfizer, and many others have established in-house capabilities.

Where outsourcing occurs in vaccine development, engagement with vaccine contract manufacturing organizations (CMOs) happens earlier in development to negate the possibility of having to transfer to another vendor at a later stage. In addition to specific manufacturing capabilities, it is necessary to find a CMO that can provide expertise in a range of ancillary functions, such as characterization and formulation, as described above. Outsourced fill and finish of vaccines can also be challenging, as very few contract service providers have the capability to formulate and fill live bacterial or viral vaccines.

With the above considerations in mind, many vaccine developers have chosen to establish their own facilities. Outsourcing of vaccine development provides opportunities to accelerate speed to market, mitigates risk, and provides task-specific technical and regulatory expertise that is otherwise expensive to hire and retain. Effective outsourced vaccine development is achievable as long as the right partners are chosen and the relationship is well managed.

Manufacturing challenges

Vaccine manufacture is one of the most challenging industries. Even the most basic manufacturing steps necessary to produce vaccines in a manner that is safe, effective, and consistent over the life cycle of a vaccine are difficult to execute. Outcomes can vary widely due to the nearly infinite combinations of biological variability in basic starting materials, the microorganism itself, the environmental condition of the microbial culture, the knowledge and experience of the manufacturing technician, and the steps involved in the purification processes.

To add to the complexity, the methods used to analyze the biological processes and antigens resulting from vaccine production often have inherently high variability.

The vaccine industry faces many challenges. One of the challenges is the time it takes to develop, test, and commercialize a vaccine, which presently is about 12-14 years. In addition to the time factor, vaccine manufacturers face a high-cost and high-risk business environment. Some of those challenges include increasing competition with other vaccine manufacturers, increasing regulatory and safety requirements, and complex technology-driven platforms.

As far as cost to develop a product, the statistics are not encouraging. It may take over $1 billion to develop a new vaccine and the overall success rate is low, with less than 10% of vaccines in Phase I development progressing to licensure.

This is a huge challenge for small companies, in which much of the innovation takes place. It explains why there are a number of collaborations, partnerships, and acquisitions. Technology development has created a booming vaccine industry, but cost and time are still challenging even for large vaccine manufacturers. The need to reach the market first highlights the importance for fast process development strategies and techniques. Such pressures have driven the vaccine industry to embrace innovative technologies.

Some vaccine manufacturers are facing additional difficulties, including the need to work with small batch sizes and varied product portfolios. During a pandemic outbreak, vaccine developers are required to provide rapid responses and use highly potent ingredients, which places a strain on the entire production process.

Vaccine manufacturing is capital-intensive, and long-term product costs are driven primarily by development and production-related economics. Costs of development and maintenance of the production process, construction and operation of manufacturing facilities, and compliance with local and international regulations are all incremental to traditional manufacturing costs such as raw material, facilities, maintenance, and labor. These are all issues that present challenges to vaccine manufacturers.

Early progress on COVID-19

Many vaccine trials are underway, some for diseases such as breast cancer, HIV, and malaria. But because of the nature of the severity of the COVID-19 pandemic, vaccine manufacturers are prioritizing the development of COVID-19 vaccines. As of April 20, 2020, several candidates for a COVID-19 vaccine are showing promise:

- CanSino Biologics is developing a vaccine for the prevention of COVID-19, Ad5-nCoV, a recombinant vaccine incorporating the adenovirus type 5 vector. On March 8, 2020, CanSino received approval from the Chinese authorities to begin human trials. This is the first coronavirus vaccine to advance to phase II trials.

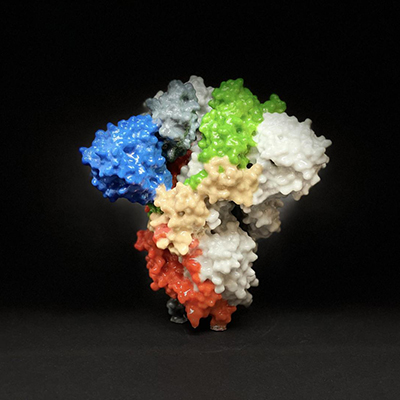

- Moderna offers its mRNA-1273, a novel lipid nanoparticle-encapsulated mRNA vaccine encoding for a perfusion-stabilized form of the SARS-CoV-2 spike protein. On March 16, 2020, the company began its phase I open-label, dose-ranging trial, occurring at Kaiser Permanente Washington Health Research Institute in Seattle.

- Inovio Pharmaceuticals announced that CEPI provided a grant to develop a vaccine against COVID-19 called INO-4800. The company is collaborating with Beijing Advaccine Biotechnology to advance the product. Preclinical testing has begun, with human clinical trials to commence in April 2020 in the U.S., China, and South Korea. It is anticipated that with positive results, some 1 million doses of the INO-4800 DNA vaccine can be produced by the end of 2020. On April 6, 2020, the company received approval to begin phase I trials. The Bill and Melinda Gates Foundation, along with other nonprofits, is supporting Inovio's COVID-19 vaccine project.

- Shenzhen Geno-Immune Medical Institute offers the LV-SMENP-DC vaccine. The LV-SMENP-DC vaccine is made by modifying dendritic cells (DC) with lentivirus vectors expressing COVID-19 minigene SMENP and immune-modulatory genes. CTLs will be activated by LV-DC presenting COVID-19 specific antigens. The project is in phase I.

- Shenzhen Geno-Immune Medical Institute has a second product -- the COVID-19/aAPC vaccine. The COVID-19/aAPC vaccine is prepared by applying lentivirus modifications, including immune-modulatory genes and the viral minigenes, to the artificial antigen-presenting cells (aAPCs). It is also in phase I.

| Select vaccines in development for COVID-19 | |||

| Developer | Vaccine | Platform | Phase |

| Moderna | mRN-1273 | mRNA | I |

| Inovio | INO-4800 | DNA | I |

| Shenzhen Geno-Immune | LV-SMENP-DC | Modified lentiviral vector | I |

| Shenzhen Geno-Immune | Covid-19/aAPC | Pathogen-specific aAPC | I |

| CanSino | Ad5-nCoV | Recombinant | II |

| GSK/Clover | COVID-19 S-Trimer | Protein subunit | Preclinical |

| IntelliStem | IPT-001 | Peptide | Preclinical |

| Sanofi/BARDA | - | Recombinant | Preclinical |

| Bharat Biotech/FluGen | CoroFlu | Self-limiting virus | Preclinical |

| NovaVax | - | Recombinant nanoparticle | Preclinical |

| Vaxart/Emergent | - | Oral recombinant VAAST | Preclinical |

| Seqiris | MF59 | Adjuvant | Preclinical |

| IRBP | RespiResponse IR101C | Cell mediated | Preclinical |

| Dynavax | CpG 1018 | Adjuvant | Preclinical |

| GSK | AS03 | Adjuvant | Preclinical |

| J&J | - | Nonreplicating viral vector | Preclinical |

| Medicago | - | Virus-like particle | Preclinical |

| Serum Institute/Codagenix | - | Live attenuated | Preclinical |

| Takeda | TAK-888 | Plasma-derived | Preclinical |

| Altimmune | - | Nonreplicating viral vector | Preclinical |

| CureVac | - | mRNA | Preclinical |

| Generex | - | Protein subunit | Preclinical |

| Ibio/Beijing CC Pharming | - | Protein subunit/plant | Preclinical |

| ImmunoPrecise Antibodies | - | B-cell selection | Preclinical |

| LineaRx/Takis | - | DNA | Preclinical |

| Tonix | TNX-1800 | Replicating viral vector | Preclinical |

| Arcturus | - | Engineered RNA | Preclinical |

| Entos | Fusogenix | DNA | Preclinical |

| Heat | - | Protein subunit | Preclinical |

| Zydus Cadila | - | DNA | Preclinical |

| AnGes | - | DNA | Preclinical |

| BioNTech/Pfizer | BNT 162 | mRNA | Preclinical |

| VBI | - | Pan-coronavirus | Preclinical |

| ISR | ISR-50 | - | Preclinical |

| SK Biopharma | - | - | Preclinical |

| Sinovac | - | DNA | Preclinical |

| Greffex | - | Nonreplicating viral vector | Preclinical |

| Cobra Biologics | - | DNA | Preclinical |

| GeoVax/BravoVax | - | Nonreplicating viral vector | Preclinical |

| Akers/Premas | - | D-Crypt | Preclinical |

To learn more about COVID-19 vaccine developments and markets, please visit Kalorama Information.

Disclosure: The Science Advisory Board is a sister company of Kalorama Information .

Copyright © 2020 scienceboard.net