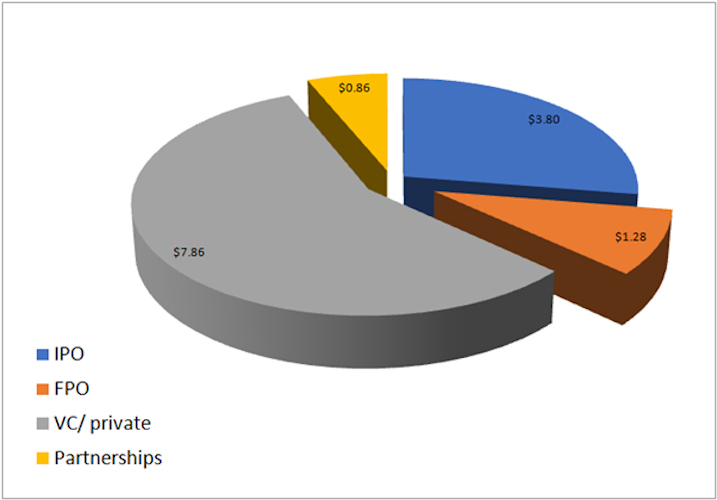

August 24, 2021 -- Rapid financing activity in the cell and gene therapy industry has exceeded $13 billion in 2021. Over half of this funding is from venture capital and private investments, with over 100 funding deals of this type.

August deals include the following:

- SeQure Dx, a gene editing diagnostics company, has announced a $17.5 million series A funding led by Rivervest Venture Partners and Mass General Brigham Ventures, along with Digitalis Ventures, Casdin Capital, KDT Ventures, Bold Capital Partners and Alexandria Venture Investments. The company says the funds will be used for initial company development, leading to the establishment of a full-service laboratory providing off-target gene editing analysis for use in drug development, clinical trials, and, ultimately, patient evaluation prior to therapy. SeQure Dx was founded on the exclusive licensure of GUIDE-seq, ONE-seq, and related assay technologies for detection of off-target gene editing events.

- Eyevensys, a privately held, clinical-stage biotechnology company developing nonviral gene therapies for ophthalmic diseases, has raised $12 million in a series B plus funding round. The Eyevensys technology is a nonviral gene therapy ocular drug delivery platform, which the company says turns the eye into a "biofactory," allowing the ciliary muscle to express and secrete the therapeutic protein to the back of the eye at therapeutic levels for a duration of greater than six months.

- Laguna Hills-based PharmaCyte Biotech, a biotechnology company focused on developing cellular therapies for cancer and diabetes using its signature live-cell encapsulation technology, announced that it had entered into agreements with institutional investors for the purchase and sale of 14 million shares of the company's common stock for gross proceeds of $70 million. PharmaCyte's product candidate for Type 1 diabetes and insulin-dependent Type 2 diabetes involves encapsulating a human liver cell line that has been genetically engineered to produce and release insulin in response to the levels of blood sugar in the human body.

Image courtesy of Cell and Gene Therapy Business Outlook.

July deals include the following highlights:

- Austrianova secured an undisclosed amount of financing from Real Tech. The funding will support the company's next stage of growth in production capacity for its protective cell encapsulation technology. It also enhances and facilitates Austrianova's entry into the Japanese market with its cell-in-a-box and bac-in-a-box technologies.

- Grit Bio has secured a round of financing that it plans to use to develop tumor-infiltrating lymphocyte therapies. The funding amount was not disclosed. The series A+ funding was led by GL Ventures of Hillhouse Group, with participation by Apricot Capital and Junshi Biosciences.

- Kriya Therapeutics closed $100 million series B financing to support its mission of transforming the design, development, and manufacturing of gene therapies. The funds will be used to further develop its core technology platforms, including its computationally enabled proprietary platform for rational vector design and its innovative high-efficiency manufacturing platform for scalable and low-cost production. The financing was led by Patient Square Capital.

- MiNa Therapeutics received a $15 million equity investment from Eli Lilly to develop novel drug candidates using MiNA's proprietary small activating RNA technology platform, which it announced on May 11.

- Prime Medicine launched with $315 million in financing to rapidly advance its gene editing technology. The $115 million series A financing and subsequent $200 million series B financing round included participation by Arch Venture Partners, F-Prime Capital, GV, Newpath Partners, and Casdin Capital, among others.

- Ring Therapeutics raised $117 million to support the continued development and expansion of its novel vector Anellogy platform. The series B financing round included contributions by Invus, Altitude Life Science Ventures, Partners Investment, and UPMC Enterprises, as well as funds and accounts advised by T. Rowe Price Associates.

- Shape Therapeutics raised $112 million in financing to continue building its growing portfolio of RNA technologies. The round of series B funding was co-led by Decheng Capital and Breton Capital.

Blake Middleton is the editor of Cell and Gene Therapy Business Outlook, part of Science and Medicine Group.

Disclosure: Cell and Gene Therapy Business Outlook is a sister publication of ScienceBoard.net.

Do you have a unique perspective on your research related to cell and gene therapy? Contact the editor today to learn more.

---

Copyright © 2021 scienceboard.net

Member Rewards

Earn points for contributing to market research. Redeem your points for merchandise, travel, or even to help your favorite charity.

Research Topics

Interact with an engaged, global community of your peers who come together to discuss their work and opportunities.

Conferences

Connect

Tweets by @ScienceBoard