June 21, 2018 --

Rarely in the scientific realm does a niche technique explode into a viable market worth billions of dollars over just a handful of years. When it does, the chaos that ensues is driven by the scrambling of life science product and service providers who vie with each other to secure market share. The market for CRISPR/Cas9 genome editing is no exception to the rule. Since its advent in the mid-2000s, the technique has continued to generate interest as more and more researchers adopt the technique. After being named the breakthrough of the year by AAAS in 2015, use of the technique has surged to unprecedented heights — and it shows no indication of slowing.

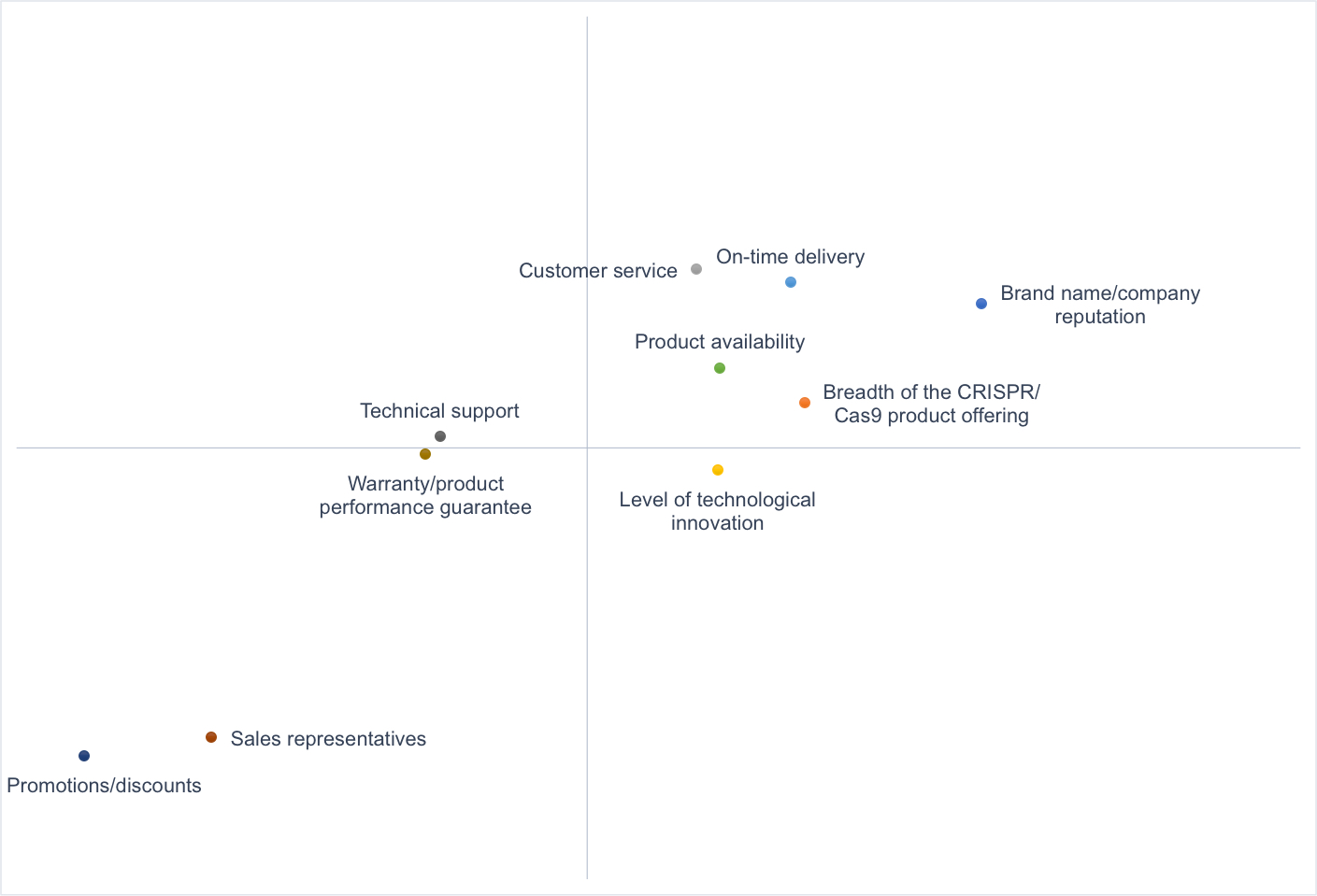

Catalog Breadth and Customer Satisfaction

The breadth of applications for CRISPR/Cas9 has spawned an enormous catalog of products and services offered by suppliers. According to our research, the breadth of product offering is a key driver in user satisfaction, right up there with company reputation and timeliness of delivery. If there is one thing scientists want, it’s for their primary supplier to be a one-stop-shop for their CRISPR/Cas9 needs.

An example of one company that recognizes this fact is Horizon Discovery. In July, the company agreed to acquire Dharmacon from GE for $85 million. The offer consisted of $50 million in cash and $35 million in equity consideration, giving GE a 9% holding in Horizon Discovery. Dharmacon provides RNAi products, CRISPR reagents, and arrayed libraries. “Through the combination of complementary technology, product portfolios, and manufacturing capabilities, the acquisition of Dharmacon by Horizon creates an emerging leader in the application of gene-modulation technologies in life science research,” stated Horizon Discovery CEO Darrin Disney. “We expect that the brand recognition, and sales, marketing (including eCommerce) and distribution channel particularly in the academic community, as well as intimate relationships in biotech and pharma that Dharmacon will bring to Horizon, will transform the opportunity for Horizon’s product portfolio as well as generate attractive cost-base synergies.”

Thermo Fisher Scientific’s GeneArt CRISPR line of products has made it the leading commercial vendor in the CRISPR market. Their product catalog includes everything from nuclease mRNA to all-in-one plasmid kits. Thanks to MilliporeSigma’s expansive product offerings that include positive control plasmids, Cas9 nickase mRNA, and CRISPR lentiviral tools, it too has become a leader in the market.

Aside from the industry giants, a multitude of smaller companies have entered into the CRISPR/Cas9 market since its advent. Non-profit AddGene is highly focused and offers a plasmid repository for scientists to use and share, making them a widely used brand.

Brand Loyalty and Switching Behavior

In such a competitive environment, suppliers of CRISPR/Cas9 products and/or services must amp up their customer satisfaction in order to stay in the game. Many have created brand ambassadors, customers who actively promote the products to their colleagues. This is common amongst many of our members who typically are more willing to try a new product upon recommendation. In the CRISPR/Cas9 space, Thermo Fisher Scientific (30.9) and New England Biolabs (31.5) have the highest net promoter scores.

19% of our surveyed members reported they were planning to switch their primary supplier of CRISPR/Cas9 products in the next 12 months. It is not surprising that lower cost is the single most influential driver of switching behavior. However, the rapidly changing products encourage switching as new members hope to gain access to more innovative technology. It is interesting to note that brand reputations forged over many years carried over into the new CRISPR/Cas9 market. For example, pharma/biotech scientists using CRISPR/Cas9 are twice as likely than their academic counterparts to say they’ll switch to Agilent – a brand often associated with advanced, and expensive, analytical instrumentation.

The market for CRISPR/Cas9 genome editing is unique in the rate at which it is expanding. We’re projecting that the market for CRISPR products and services will grow at astonishing 45% over the next five years. We expect to see new innovations continue to roll out. This is an exciting time for life sciences and more specifically, the findings and successes that will come from genome editing.

Who is your CRISPR/Cas9 supplier? What features would make it even more beneficial for your research? Start the discussion below!

Copyright © 2018 scienceboard.net